4 Gap Trading Strategies that you should know.why does market open gap up or gap down?

Are you looking for Gap trading strategy? In this article we will be showing you how to use gap trading sytem in stocks using Supply and Demand trading strategy. Gaps are nothing but Invisible candles, which is caused by a sharp move up or down with little or no trading happening in between the previous days close and the current days open. A trader can use these Gap Trading Strategies and trade them and earn good profits. This Article will help you understand how to trade Gaps, why they occur and how to trade them profitably using Supply and Demand Trading Strategy. The fourth gap is the best, read till the end to find out why.

What Are Gaps?

Gaps are nothing but Price of a Stock moving up and down sharply with no or little trading happening between the previous days close and current days open. Gaps show an ultimate picture of imbalance between supply & demand. Gap formations are due to many fundamental and technical reasons.

Most common example, when there is an announcement of company earnings. Gap Up or Gap Down is imminent the next trading day due to positive or negative news. A trader can profit from gaps provided he/she can identify the type of gap and its location with perspective to Institutional Supply & Demand Zones.

Why Does the Market open Gap up or Gap down?

A gap up occurs when the Current days price opens beyond the prior days high and prior days low. A gap is a sharp movement in price that is an invisible candle. This happens when there are certain market factors like an earnings report of a company that is released after market hours. A gap up can also happen when, there are certain economic factors revolving around that particular stock.

Similary ,a gap down in a market happens when the current price of the stock or instrument open below the prior days low and high. hence, if a particular company has had a bad earnings report, a gap down occurs. A lot of Day traders , scalpers , Swing traders can understand how gaps are created and hence plan their trades accordingly.

Gap Trading Strategy using Supply and Demand Zones

A lot of traders are fearful of Gaps and see it as a threat & aren’t comfortable carrying positions overnight. However, for a professional Supply Demand Trader, these Gaps aren’t threats on the contrary they provide high probability trading opportunities.

We do not look at Gaps; the way most conventional technical analysts do. We combine Gaps with Supply Demand Zones & have classified them into four types.

Types of Gaps trading Sytems

There are 4 types of Gaps

- Inside Gaps

- Outside gaps

- Novice Gaps

- Professional Gaps

Let’s us discuss each of these gaps in detail.

1. What is Inside Gap Trading?

Inside gaps are created when Price Opens between the prior Day’s High and low. Often these gaps fill quickly on the same day. Inside gaps can be mainly used for quick intraday trades, provided they happen at strong supply & demand zones.

Gap Up into a strong Supply Zone provides a good short opportunity, whereas Gap Down into a strong Demand Zone presents a good long opportunity. Let’s see an example

If you want to LEARN how to identify, read this high probability Supply & Demand Zones.

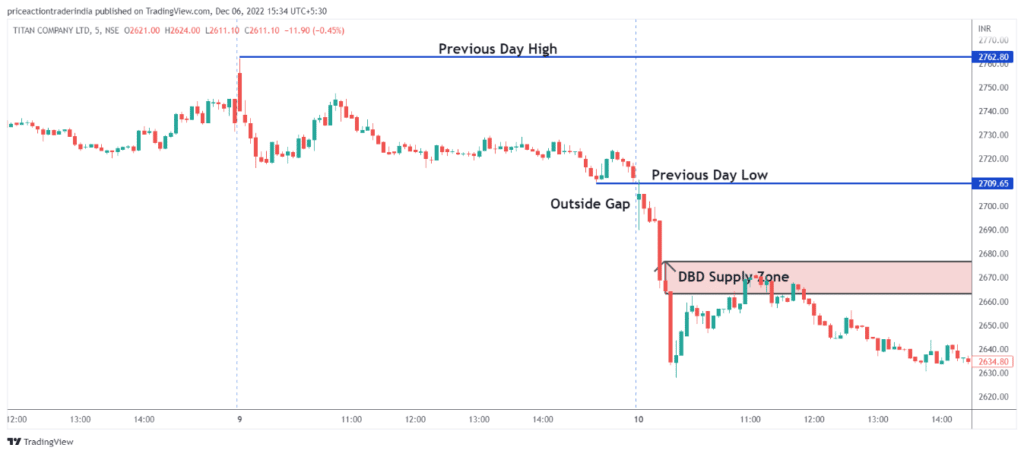

2. What is Outside Gap Trading?

Outside gaps are created when Price opens beyond the Prior days High and low. These gaps generally do not fill on the same day. They indicate the establishment of a new Trend or the continuation of the existing one.

One must wait for quality Supply & Demand Zones to form after the gap and wait for a pullback to join the new move. Let’s see an example

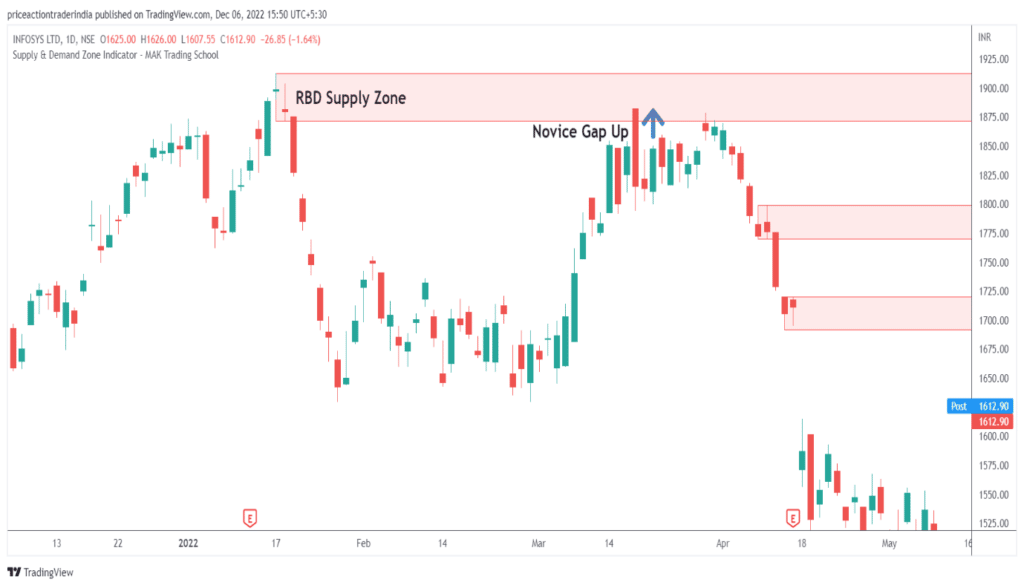

3. What is Novice Gap Trading?

When price gaps in the same direction of the current trend, then it is called a Novice Gap. Novice gaps as the name suggests are created by novice trader emotions and are excellent opportunities to find high probability trade setups.

Gap Up or Gap Down after extended moves into quality areas of Supply & Demand, offer us high probability Short & Long opportunities respectively. Let’s see an example

4. What is a Professional Gap?

When price gaps up in the Opposite direction of the current trend, it is called a Professional Gap or a Pro gap. Pro gaps represent a significant imbalance between Supply & Demand.

Pro Gaps generally occur after extended moves in one direction, taking the amateur traders completely by surprise. They generally bring about trend change. Pro Gap Down & Pro Gap Up form high probability Supply & Demand Zones. Pull back to these zones provide us with opportunities to enter at trend change points. Let us see with an example.

To learn more about GAP trading strategies, join the Trading Mantra Workshop

Conclusion

For any strategy to be successful it requires sound risk management & trade management rules. We as Supply Demand Traders have a sound ruled based approach to quickly identify and trade these Gaps with a high degree of accuracy.

To identify & trade the gap trading system effectively one needs to be well versed with Supply & Demand Trading Strategy. MAK Trading school has covered many such finer nuances in their Core Strategy -Course.

Stock market trading requires one to have a successful Trading Strategy which most importantly suits one’s mind-set. If you are a beginner searching for such a strategy, then we would suggest you first get trained in Supply Demand Trading methodology. This strategy works across asset classes and across time frames.

Pro traders who want to take their learning deeper, will immensely benefit from the advanced concepts covered in the Core Strategy -Course. Till then Happy Trading!

FAQ's

Q1.How do you successfully trade gaps?

People can successfully trade gaps with the help of Supply and Demand Zone. A trader can trade supply and demand zones

when the price of a stock gaps up or gaps down.

Q2.Can you make money trading gaps?

2 Comments.

Want to see a trail

Thanks for your comment, are you looking for the Automated Indicator and Alerts for Supply and Demand Zones? If you are interested please send us an email at support@learn.maktradingschool.com we will be happy to help you out, you can also call us on 7400088842